People of Earth,

My name is Michael Loomis. I am a Southern California native. I have spent almost every day of my life in Long Beach, a Los Angeles suburb. I’ve spent 51 years here, and I love it. Everything about this place.

I wanted to take a moment and talk to ALL of you today. We are living in a fabulous time, a time when more people have access to basic goods and services necessary to make life possible without overdue burdens. By no means have we solved poverty and starvation on a global scale, but we are witnessing a revolution in technology, industry, and now intelligence that is allowing us to understand better how we can meet ALL of our basic needs. Food, shelter, clothing, and health care.

Over the last few decades, we have witnessed unprecedented growth in computer technology, which has allowed us to access vast amounts of data in a very short space of time. The libraries of the world are now online, which allows our large language models to be accessed by artificial intelligence engines in a way and at a rate that the human mind could have never imagined just a few short decades ago. In no uncertain terms, we are now witnessing the advent of a new age. An Intellectual Revolution born out of the foundation of the Industrial Revolution that began in the middle of the eighteenth century.

The time has come and now is when and where we need to embrace and welcome the reality of where we are in the passage of time. We have been born into a time and space where human labor and planning for the future are becoming a thing of the past—things that our future generations will only be able to understand through the lens of history. Whether it is our children, grandchildren, or great-grandchildren, there will come a day in the near future when that last job will no longer need to be filled. No more working by the sweat of our brow to provide for our daily bread. Our basic needs. And we need to prepare for it. There will be no more inequities.

And now I imagine you have a question that has been swirling around, forming in your mind about how we are going to prepare for this inevitability. This, I imagine, is followed by another question: What are we going to do with all the time that will be freed up because of this inevitability? And if there is no more work that needs to be done, how are we going to pay for our basic needs and luxuries?

At this point, we already live in a time of luxury compared to all of recorded human history. Consider that. Now consider this: We humans are the only species on Earth that has had the inclination to take that which was once free and accessible to all and put it behind lock and key. Food, shelter, and clothing were historically accessible to all mankind long before there were jobs, payroll, banks, and human resource departments. And today, if someone down on their luck is caught taking that which is behind lock and key without paying for it, we then put them behind lock and key, giving them food, shelter, and clothing, their basic needs for free. Kind of ironic, isn’t it?

Allow me to address some of those questions about the future that are likely swirling around in your head.

First of all, just because there will be no more jobs, that doesn’t mean that there will be no work to be done. Far from it. There will be plenty for us to do to ensure that all goes well. However, it will look different. The reality is that we are all going to need to accept these changes in work and meaning because the old way will have faded off into obscurity.

No longer will a household, say a family of four, need to work forty to eighty hours a week just to meet their basic needs. And I can hear the question now, “But who’s going to pay for it all?”

This is the wrong question to ask. The right question would be, “Why would we still need to pay for it?” The answer would be that we need to remedy the problems that led to the need to pay for it and replace them with solutions that would eliminate 84% of the financial burden that requires our human resources in exchange for pay.

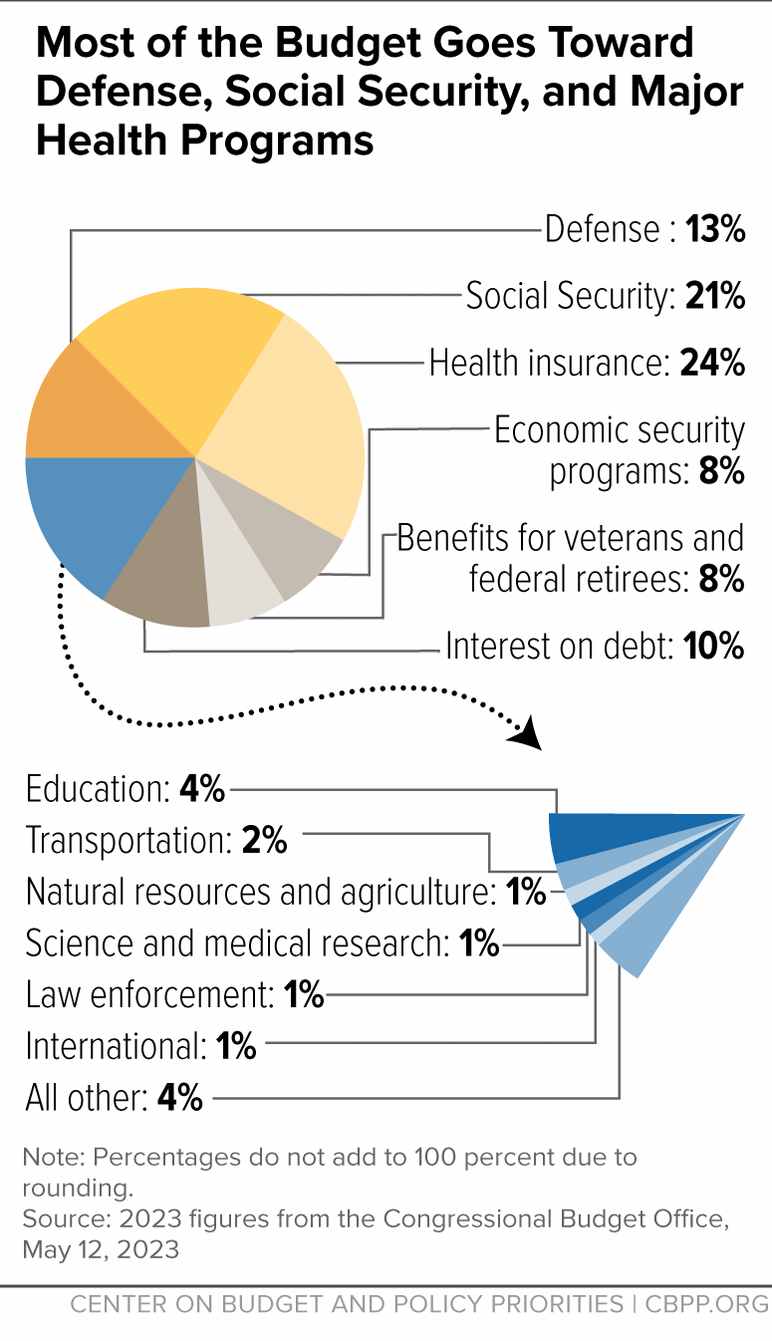

Above Image(Cbpp, 2023)

trillion divided by million United States Citizens is approximately $70,262.

And then there is the money that employers add to the pot that would be freed up to fund the future.

The total cost to an employer for an employee extends well beyond the hourly wage due to benefits, insurance, office space, taxes, and other related expenses. This total cost is often referred to as the “burden rate” or “fully loaded cost.” The specific amount can vary significantly depending on the industry, location, and size of the company, as well as the specific benefits offered. Here’s a breakdown of some of the typical additional costs:

- Benefits: This can include health insurance, dental and vision insurance, retirement benefits (e.g., 401(k) contributions), life insurance, and disability insurance. Benefits can add 20% to 40% or more to the base salary.

- Employer Payroll Taxes: In the United States, for example, employers must pay Social Security and Medicare taxes, which amount to 7.65% of the salary. There might also be federal and state unemployment taxes.

- Workers’ Compensation Insurance: This varies by industry and state but is a mandatory cost for most employers.

- Training and Development: Costs associated with onboarding, training, and professional development can also add to the total cost.

- Office Space: The cost of providing a workspace, which includes rent, utilities, office supplies, and equipment, can vary widely depending on location and the nature of the business.

- Technology and Equipment: Computers, software licenses, communication tools, and other technology needs can add to the cost.

- Miscellaneous Costs: Other costs can include travel expenses, employee perks and wellness programs, and administrative support.

On average, the additional costs can range from 1.25 to 1.4 times the base salary, but this is highly variable. For a more precise calculation, it’s essential to consider the specific factors related to the industry, location, and company benefits package. Employers often conduct a detailed analysis or use calculators provided by HR services to estimate these costs accurately.

The above information was drawn from ChatGPT.

https://www.cbpp.org/research/policy-basics-where-do-our-federal-tax-dollars-go

Cbpp. (2023, September 29). In case you missed it… Center on Budget and Policy Priorities. https://www.cbpp.org/blog/in-case-you-missed-it-674

Policy basics: Where do our federal tax dollars go? (2023). Center on Budget and Policy Priorities. https://www.cbpp.org/research/policy-basics-where-do-our-federal-tax-dollars-go

More to come…Back to homework for now…8)